About half of Romania's counties will be eligible for 60% non-reimbursable support from this year for investment projects

The European Commission has given the green light to Romania to increase its state aid support and funding intensities from a maximum of 50% until the end of last year to 60% from this year until 2027.

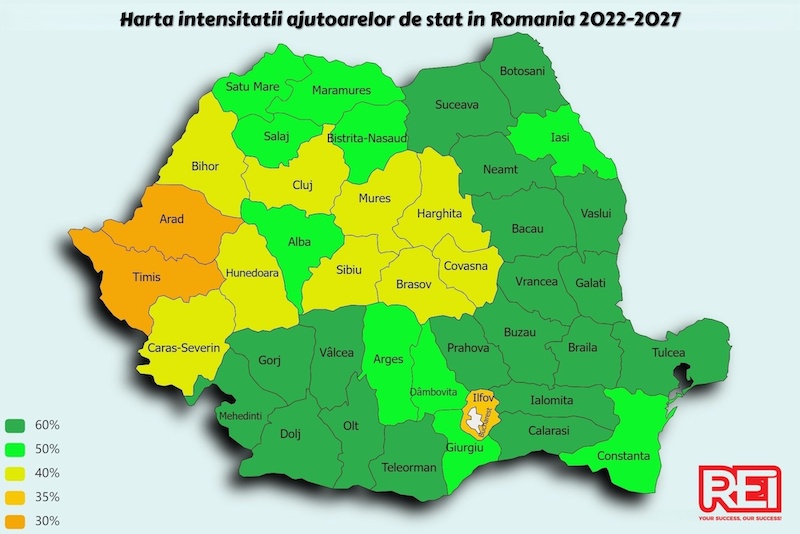

According to a REI Finance Advisors analysis, about half of Romania's counties will be able to obtain 60% of the non-reimbursable support requested by companies applying for state aid starting this year, both on state aid schemes, such as the one regulated by GD 807/2014, and on operational programmes that have a state aid component, such as the Regional Operational Programme (ROP), a programme that will begin this summer and on which companies will be able to submit projects.

The measures to change the intensities come after the European Commission has analysed the situation of previous allocations and the degree of absorption of funds, and under the new proposal aims to stimulate investment in depopulated counties or in the process of depopulation, to limit the imbalances between more developed and less developed regions of Romania.

According to the European Commission, seven regions in Romania (North-West, Centre, North-East, South-East, South-Muntenia, South-West Oltenia and West) are among the most disadvantaged in the EU, with a GDP per capita below 75% of the EU average. They are therefore eligible for aid under the derogation provided for in Article 107(3)(a) TFEU (so-called "A" areas), with maximum aid intensities for large companies ranging from 30% to 60%. According to the EC, around 90% of Romania's regions will be eligible for investment support through state aid.

Thus, Botosani, Suceava, Neamt, Bacau, Vaslui, Vrancea, Galati, Tulcea, Braila, Buzau, Prahova, Ialomita, Calarasi, Teleorman, Olt, Valcea, Gorj, Dolj and Mehedinti are the 19 counties that will benefit from allocations of up to 60% in projects carried out through state aid in the coming years. To the 60% support is added 10% for medium-sized companies (50-249 employees, with no more than €50 million turnover) and 20% for small companies (0-49 employees, no more than €10 million turnover, according to the thresholds set by Law 346/2004).

The counties of Satu Mare, Maramures, Salaj, Bistrita-Nasaud, Iasi, Alba, Arges, Dambovita, Giurgiu or Constanta will benefit from allocations of up to 50% of the value of investment projects carried out in the coming years.

The counties of Bihor, Caras-Severin, Hunedoara, Cluj, as well as those in the centre of the country - Mures, Harghita, Covasna, Sibiu or Brasov - will have allocations of up to 40% of the value of the investments carried out, while the counties of Timis and Arad will have a reduced allocation compared to the previous range, from 35% to 30%.

"Against the backdrop of a total absence of European investment funds dedicated to SMEs in the last 2-3 years, the low level of allocations that we had expected, however, through the PNRR and the difficulties generated by the coronavirus pandemic, these changes are welcome. We are ready to submit over 200 projects in 2022 and further develop the team with senior consultants with expertise in finance, industrial domain and construction. We aim at reaching a number of at least 60-70 consultants in the coming months and open two more offices to be much closer to companies, as we expect this year to be richer in funding sources as compared to 2021. We will submit projects on POC 4.1.1 starting in February, we will have guidelines and will submit on Regional Operational Programme (ROP) in the summer, then digitization and other PNRR programs in the second half of the year", said Roxana Mircea, partner at REI Finance Advisors, one of the largest consulting companies in Romania, specializing in attracting non-reimbursable funds, both through European funding and state aid, for companies operating locally.

Ilfov county, support between 35 and 45%, depending on the area. The Capital, with no state aid projects starting this year

According to the regional map approved by the European Commission, Ilfov county has been divided into two areas. Thus, eligible for grants of up to 45% are the localities Peris, Ciolpani, Snagov, Gruiu, Nuci, Gradistea, Petrachioaia, Dascalu, Moara Vlasiei, Balotesti, Corbeanca, Buftea, Chitila, Glina, Cernica, Dobroesti and Pantelimon, while Ciorogarla, Domnesti, Clinceni, Cornetu, Bragadiru, Darasti-Ilfov, Jilava, 1 Decembrie, Copaceni, Vidra and Berceni are eligible for 35% state aid funding. The percentages of 35% and 45% are valid for large companies. Medium-sized companies can receive an additional 10% and small companies another 20%, reaching 65% non-reimbursable funding through GD 807/2014.

As of this year, Bucharest it is no longer on the map of non-reimbursable state aid funding, as is the Scheme regulated by GD 807/2014, with amendments to be adopted during January, according to the document available for consultation on the Ministry's website. Companies wishing to invest in the capital will have to turn to other sources of funding available for the area.

"Small and medium-sized companies will have the Regional Operational Programme (ROP) at their disposal, with allocations of around €80 million for investment in tangible assets and €40-45 million for digitisation. Large companies, unfortunately, will have to turn to other sources of funding", added Roxana Mircea.

Session continuously open through the State Aid Scheme regulated by GD 807/2014

One of the most popular funding solutions provided by State Aid is GD 807/2014, a scheme that provides up to €37.5 million in non-reimbursable funds for investments of at least €1 million.

The session is continuously open, projects are managed by the State Aid Department of the Ministry of Finance, and the main obligations of a company receiving state aid are to maintain the average number of employees in the last 12 months prior to the application and to pay taxes on the new investment project in an amount equal to the grant in 5-7 years, taxes related to salaries of new employees, corporate tax, building tax, etc.

If at the end of the 5-7 year period the company does not pay taxes at the level of the grant, it will strictly return the unpaid amount + interest of 2.27 +1%.

"The initial documentation must contain the general estimate, estimates/objective and memorandum, market study proving unmet demand, market share etc. When submitting the project the company does not have to own the land or prove co-financing. The real right or proof of use of the hall as well as the sources of financing must be submitted within 6 months after the Agreement is issued. The evaluation period is much shorter, between 3-6 months, compared to European funds, where the process is more laborious. In addition, you can start the investment project as soon as you have submitted the funding application to the Ministry of Finance", Roxana Mircea added.

A very welcome change this year to the State Aid Schemes is the increase in the percentage of non-reimbursable funding by 10% for medium-sized companies (50-249 employees) and 20% for small companies (0-49 employees), defined by Law 346/2004.

"We advise companies to analyze what fees they can pay in 5-7 years on new investment projects they want to undertake and, based on this aspect, apply for state aid through the Scheme regulated by GD 807/2014. Small and medium-sized companies have more sources of funding unlike large companies in 2022 and we encourage entrepreneurs to rigorously prepare projects on POC 4.1.1 (maximum 95% funding, maximum 1 million euro), ROP, digitalization etc.", said Roxana Mircea, partner at REI Finance Advisors.